Fed Rate Decision Update: What to Expect at the October Meeting

As we approach the Federal Reserve’s October 28-29 meeting, there’s significant buzz in the real estate and financial markets about what’s next for interest rates. If you’ve been following my previous insights, you know I’ve been cautious about expecting rate cuts this year. However, recent developments and market signals are painting a clearer picture of what’s ahead.

What’s Happening at the October Fed Meeting?

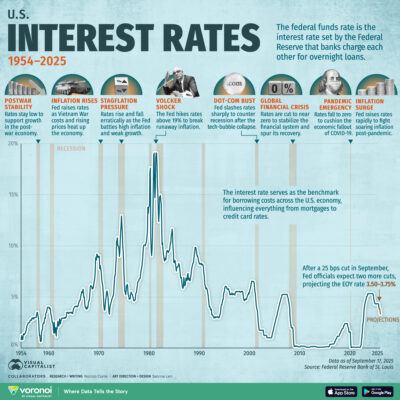

The Federal Reserve is set to convene in just days, and market analysts are closely watching for the next move. According to current market expectations, we’re likely to see a 25 basis point rate cut, which would lower the federal funds rate to a range of 3.75%-4.00%.

This anticipated cut represents a measured approach by the Fed as they navigate the delicate balance between controlling inflation and supporting economic growth.

The Fed Is Divided on How Much to Cut

What’s particularly interesting is that Federal Reserve Governors themselves aren’t in complete agreement. Governor Miran is advocating for a more aggressive half-point cut, while Governor Waller supports the more conservative quarter-point reduction. The committee consensus appears to be leaning toward the quarter-point cut—a cautious but meaningful step.

This division within the Fed reveals the complexity of the current economic situation. They’re threading the needle between doing enough to support the economy while not moving so aggressively that they risk reigniting inflation concerns.

What Do the Experts Say?

Fed Chair Powell has been relatively clear about the roadmap, emphasizing that the Fed will likely cut rates twice more this year. With meetings scheduled for October and December, Wall Street traders are betting that cuts will follow at both gatherings.

However, there’s always a gap between projections and reality. Economic data can shift quickly, and the Fed has shown they’re willing to adjust their plans based on incoming information about inflation, employment, and overall economic health.

Impact on Mortgage Rates

For Bay Area homebuyers and those looking to refinance, the critical question is: what does this mean for mortgage rates?

Currently, the average 30-year fixed mortgage rate sits at 6.27%. Experts project rates will hover around 6.3-6.4% by year-end. While a Fed rate cut doesn’t directly determine mortgage rates, it does influence the overall lending environment and can create downward pressure on rates.

The reality is that even with potential Fed cuts, we’re unlikely to see dramatic drops in mortgage rates in the near term. The market has already priced in much of the expected Fed action, which is why mortgage rates haven’t moved significantly despite cut expectations.

What This Means for Bay Area Real Estate

For South and East Bay buyers and sellers, the takeaway is this:

For Buyers:

• Don’t wait for dramatically lower rates—they may not materialize soon

• Current rates around 6.3% are workable if you’re qualified

• You can always refinance later if rates do drop significantly

• Focus on finding the right property rather than timing the rate market

For Sellers:

• Modest rate improvements could bring more buyers to the market

• Pricing competitively remains crucial regardless of rate environment

• Buyers are adapting to current rates and are still actively shopping

My Updated Perspective

In my previous blog, I expressed skepticism about seeing rate drops this year, even though the Fed projected two more cuts. I wanted to be realistic about expectations given the economic uncertainties we’ve faced.

However, with the October meeting just days away and strong market consensus pointing to a cut, I’m revising my outlook. We will likely see one more rate drop in 2025—specifically at this upcoming October meeting. The quarter-point reduction appears almost certain at this point.

As for the December meeting? I’m maintaining some healthy skepticism. While the Fed has indicated two more cuts are possible, a lot can change between now and December. Economic data, inflation reports, employment numbers, and global economic conditions will all play a role in that decision.

My updated prediction: expect one more rate cut this year, but don’t count on two. The Fed will likely take a wait-and-see approach after October, reserving the right to pause if economic conditions warrant it.

The Bottom Line for Bay Area Homebuyers

Whether we get one more rate cut or two, the impact on your mortgage rate will likely be modest—perhaps a quarter to half percentage point at most by year-end. That’s meaningful, but it shouldn’t be the deciding factor in your real estate decisions.

The Bay Area market remains strong, with limited inventory and solid demand. If you’re qualified to buy and you’ve found a property that meets your needs, today’s rates are historically reasonable. Waiting for the “perfect” rate could mean missing out on the right home or watching prices appreciate further.

Stay Informed with Avil Soleiman Brokerage

As a South and East Bay realtor with Avil Soleiman Brokerage, I stay on top of these market developments because they directly impact your real estate decisions. Whether you’re looking to buy, sell, or simply understand what’s happening in the market, I’m here to provide the guidance you need.

The Fed’s decisions matter, but your personal financial situation, goals, and the local real estate market dynamics matter even more. Let’s discuss how current conditions affect your specific situation and create a strategy that works for you.

Want to discuss how the Fed’s rate decisions impact your homebuying or selling plans? Contact me today for a consultation where we can review your options and develop a personalized strategy for navigating the Bay Area real estate market in any rate environment.